ICO Pass Makes KYC Verification Simple And Fast.

what is ico pass..??

ICO Pass is the easiest based to do KYC checks. ICO Pass verifies authenticity of person's ID documents, does a face matching. It makes passing a KYC verification a simple and easy task. ICO Pass is developing a set of tools to gather, verify, and exchange information. This kind of services is got a very high demands on ICO's.

The ICO Pass process is very fast, secure, and efficient. It verifies the person's ID card, do a face matching, etc. All data is protected and encrypted so there are no one can access it. The cost of KYC process is reduced because ICO Pass is automated an accurate.

ICO Pass have a mobile application that can use to gathering information with a webservice. The Mobile App of ICO Pass will be available after ICO Pass Crowdsale. Mobile app can be used for taking photos, verifying phone numbers, and loading documents.

The ICO Pass process is very fast, secure, and efficient. It verifies the person's ID card, do a face matching, etc. All data is protected and encrypted so there are no one can access it. The cost of KYC process is reduced because ICO Pass is automated an accurate.

ICO Pass have a mobile application that can use to gathering information with a webservice. The Mobile App of ICO Pass will be available after ICO Pass Crowdsale. Mobile app can be used for taking photos, verifying phone numbers, and loading documents.

ICO PASS Structure

The document is divided into multiple parts. The first part describes the workings of the main ICO Pass components — the mobile client, the verification webservice, the KYC providers and the smart contracts used to store and retrieve information about ethereum addresses. The second part describes the mechanics of the token sale.

Finally, at the end of the document, there are multiple appendices. These include more in-depth explanations, as well as the full source code of the Ethereum smart contracts at the time of publishing this document.

Smart Contracts

There are two type of ethereum programs in the scope of ICO Pass:

- infrastructure contracts for verifying key holders, publishing signed attributes, attribute lookup, etc.

- verifier contract — smart contracts and libraries for consuming the ICO Pass information.

Working back from these assumptions, we have decided on a few design goals:

- payments from non — eligible addresses should be refused at the smart contract level. This will reduce the amount of work required afterwards to refund non-eligible contributors.

- enabling contributor verification should be simple — ideally with no more than just a Solidity function modifier. This should ease auditing constraints.

- additionally — a proxy contract can be deployed to forward only verified funds. However, since an audited crowdsale would have to audit the whole setup, then a proxy contract does not offer significant advantages over a Solidity function modifier.

To satisfy these constraints, the KYC data needs to be queryable from Ethereum. On the blockchain, ICO Pass consists of a suite of contracts, which facilitate:

- proving ethereum address ownership to a verifier.

- a claim registry, where subject addresses can be matched to data (signed by a given verifier).

Initially ICO organizers who would adopt the ICO Pass, would have to trust the ICO Pass verification key signatures — because there would be no other verifiers. However, in theory, new verifiers couldappear and submit information about ethereum addresses.

Roadmap

February 2017 — ICO launch. Product launch.

Mar 2018 — New databases are added for higher accuracy.

April 2018 — Video identification with live agents added.

May 2018 — ICO organizer communication tool added for contacting ICO contributors.

June 2018 — Integration with US State Revenue Service or Banks to automatically determine if the investor is accredited. First US based ICO.

November 2018 — Integration finished with Banks who in EU are providing their APIs under PSD2 regulation. Automatically determines if the person is accredited investor.

December 2018 — Interest payout functionality in app.

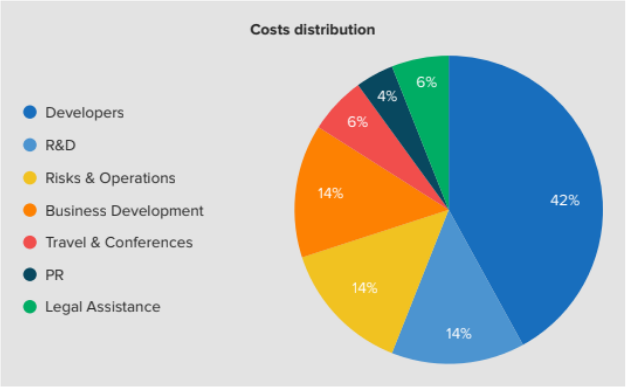

Use of raised funds

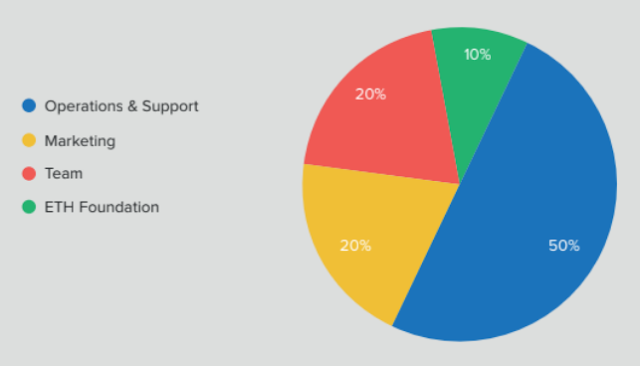

Once the company has finished the roadmap features and has used the funding from Token Sale, it will purely rely on the funds generated with ICO Pass opened tokens. ICO Pass tokens will be allocated as following (see diagram):

50% of the tokens will be used for covering operations, supportand further development of the product. These tokens will not be sold.

10% will be donated to Ethereum Foundation in order to support further development of blockchain technology.

20% will be allocated to Marketing. These tokens will not be sold, however they can be given out to other parties in order to promote the service.

20% will be allocated to the team. These tokens will have 1 year period in which they cannot be sold.

Token Sale Information

The Sale is an auction type sale, for which the token price is time dependent (tokens get cheaper the longer the sale runs), and sale duration is allocation dependent (the more tokens are bought, the earlier the sale’s deadline).

In total, ICO organizers will sell 20m ERC20 tokens, called ICOP. Once organizers issue a new token KYC Pass for banks (KYCP), ICOP holders will be able to get 5 KYCP tokens for every ICOP token they hold at no extra cost. KYCP token holders, on the other hand, will not be able to get tokens for ICOP.

Discount

There will be an early participation bonus period. The sale will start with an initial 15% ETH bonus for the first hour. For example, somebody spends 100 ETH within the first hour (and this event is included in the blockchain), whereas someone else spends 115 ETH a day later. Both will receive the same number of ICOP tokens. For every period where 2 blocks are confirmed without new contributors, the early participation bonus will drop by 1 percentage point. After the 14th occurrence of this, or after 24 hours (whichever comes first), the early contribution bonus will end.

Sale period

The crowdsale time should range from a bit more than a month (with no contributions) to 2 weeks (reaching the desired contribution size).

Token allocation

Tokens will be issued to investors immediately after the end of the sale.

Revenue allocation

Token holder will be able to claim the share of revenue every quarter. Revenue will be available for claiming 15 days after the end of quarter.

Example of the sale

Organizers create 20m tokens and begin the token sale. Janis decides to participate and sends 10 ETH to the token sale address while the rate is at 10 ETH = 1 ICOP. If it is not possible to sell all the tokens at the current price, sale continues and the price is lowering as it goes on. Eventually at 0.1 ETH = 1 ICOP it is possible to sell all the tokens. The sale ends and Janis, instead of receiving 1 ICOP receives 100. In other words, even if a person decides to buy tokens early, the lowest price is applied to all the purchasers.

Exchanges where tokens are listed

Initially exchange of tokens will be possible directly between users using Decentralised Exchanges such as Radar Relay.

For More Information ;

Website : https://icopass.id/

Facebook : https://www.facebook.com/icopassid

Twitter : https://twitter.com/icopassid

Author : Melati21

Profile link : https://bitcointalk.org/index.php?action=profile;u=1357963

Tidak ada komentar:

Posting Komentar