TOKENLEND - DECENTRALIZED LENDING PLATFORM.

TokenLend will give anyone across the globe the ability to invest in real estate secured loans using various crypto and fiat currencies.

Our platform will remove the uncertainties which small investors normally face by helping them build a secured loan based investment portfolio that delivers a competitive, predictable and consistent return.

Traditional banking products and services are archaic and slow due to all their red tape and paperwork. In a world of cross-continental currency transfers, decentralised databases and smart contracts, people are still limited by their geographical location and residency. Different legislations, currencies and complex taxation make business activities more complicated than it should and could be. The lack of integration between financial services force people to deal with numerous middleman institutions with their own verification policies, fees and limits. This can turn a seemingly simple operation into a massive headache.

TokenLend is a reliable ecosystem helps the users to invest in secured loans using various cryptocurrencies and fiat currencies. Their platform will remove the uncertainties that come with small investors by helping them build a secured loan based investment portfolio that delivers a competitive, predictable and transparent solution.

The platform will release pre-arranged list of secured loans from trusted EU loan originators. They have a user friendly portal with a simple registration process. They also have person internally to revalidate the information filled in by the borrower’s which consists of personal details, pledge appraisal and LTV ratio. Once, these details pass TokenLand’s terms, regulations and criteria they will go on to be listed on the platform.

The platform will release pre-arranged list of secured loans from trusted EU loan originators. They have a user friendly portal with a simple registration process. They also have person internally to revalidate the information filled in by the borrower’s which consists of personal details, pledge appraisal and LTV ratio. Once, these details pass TokenLand’s terms, regulations and criteria they will go on to be listed on the platform.

- The platform provides a suite of tools for potential investors and lenders through an easy-to-use web interface. The core features contained in TokenLend are:

- The loan market where the lender will offer the opportunity for the user to invest and receive income.

- Market Loan Participation Note (LPN) is a "Secondary Market" where users can trade in sustainable investment for liquidity.

- Payment gateways that allow users and lenders to deposit and withdraw funds from their accounts.

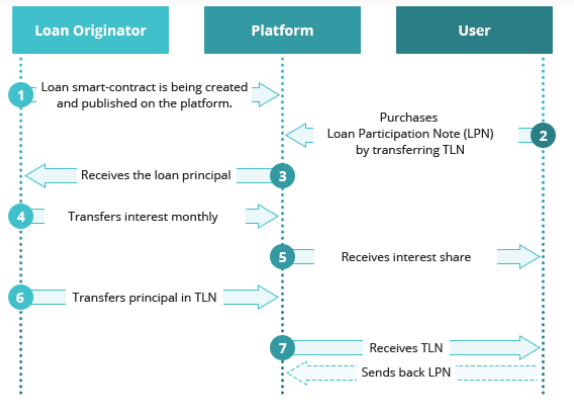

- The originator of the loan adds a new loan to the system through the Dashboard. Once loan details are validated and successfully verified by platform personnel, smart loan contracts are created and published to the platform.

- Users purchase Loan Participation Notes (LPN) for a particular loan by transferring the desired amount of TLN to the loan address. The loan smart contract then generates an LPN contract with a principal amount equal to the amount of TLN transferred by the user as well as a personal repayment schedule based on LPN time stamps and loan terms.

- LPN is related to the ETH wallet address of the user as the recipient of the interest payment. The total amount of TLN received from all users is transferred to the Originator Credit account as the principal of the loan.

- According to the schedule of smart loan contracts, the lender sends interest payments and principal payments (if applicable) to the platform.

- After the last transaction by the lender, the LPN contract closes the repayment schedule and sends the interest along with the remaining principal of the TLN loan to the respective account.

- The loan is then deemed to be closed, then the association of the wallet address is issued and the LPN contract is considered fully executed

That's a quick review of Tokenlend. Hopefully, it can be useful for readers and for investors to take steps to participate in the success of this project.

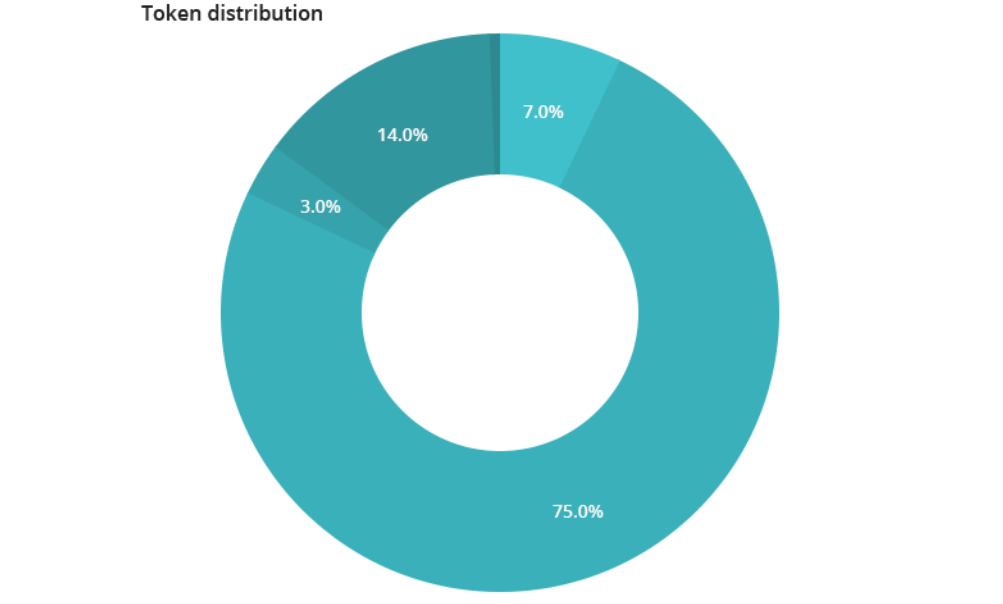

The token is denoted by the symbol TLN and it entitles the membership on the TokenLend platform. They are ERC-20 tokens, with the exchange rate of 1 TLN = 0.0004 ETH and 1 ETH = 2500 TLN. A total of 473 466 667 TLN tokens will be created for the purpose of sale and upto 33 142 666 TLN tokens will be sold during the pre sale.

The start date of the crowdsale is fixed at 6th of March 2018 and will go on for 45 days. The presale is set to cap a total of 11047 ETH and will begin on 1st of March 2018 and run for 11 days. At the end of ICO, the TLN tokens will be transferable for upto 7 days. They also have various pre-sale bonuses depending on the total purchase.

The start date of the crowdsale is fixed at 6th of March 2018 and will go on for 45 days. The presale is set to cap a total of 11047 ETH and will begin on 1st of March 2018 and run for 11 days. At the end of ICO, the TLN tokens will be transferable for upto 7 days. They also have various pre-sale bonuses depending on the total purchase.

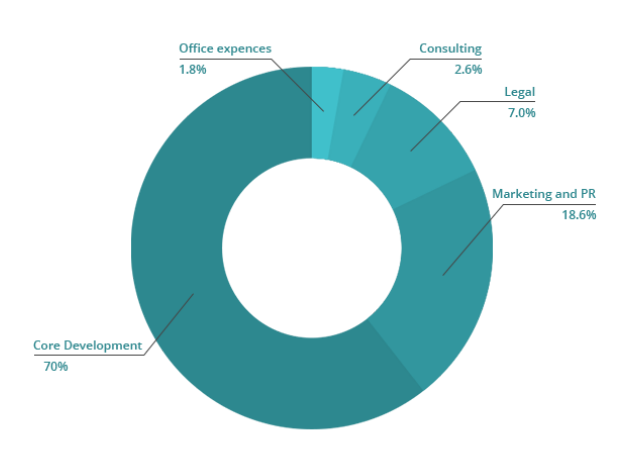

Regarding the allocation of funds, the important departments will receive them in accordance with their needs. 70% of the funds will be allocated to the entire development process. 18.6% will go towards the external marketing and branding of the platform. This is the biggest revenue generating department in the company. The rest of the budget will be allocated to legal aspects, consulting purposes and the office expenses like Rent, utility etc.

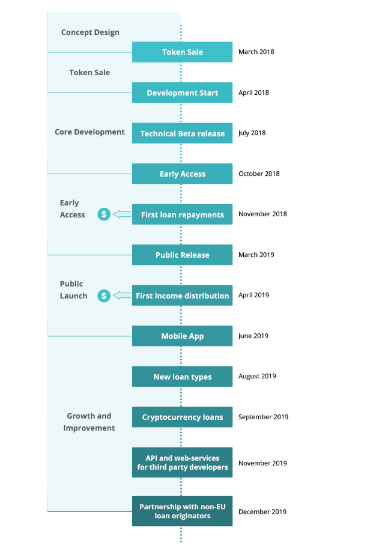

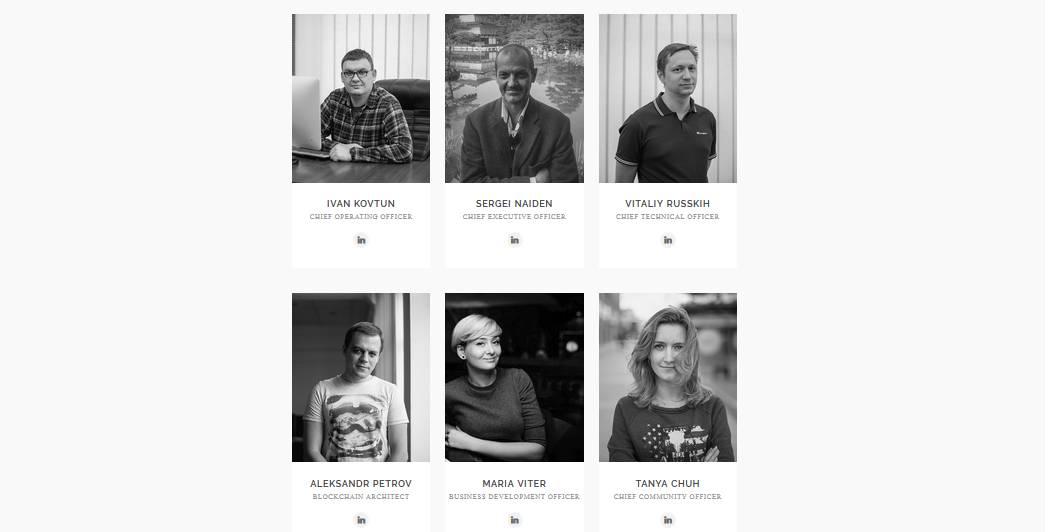

The team consists of developers, blockchain specialists and investors who are inspired by one dream- to build a robust and user friendly loan investment. The team has previously built the world famous software product, DAEMON Tools. The ecosystem is on the road to becoming one of the biggest and most trusted lending management platform. They are supported by the growing need of a transparent and consolidated lending industry. The team has a very promising road map with future potential for disruptive growth.

A Blockchain technology based transparent and secure platform will solve the problems which we face in our financial life.Real Estate as security is the key for the platform. The platform will ensure success for both the investors and the customers and will revolutionize the lending economy.Join this wonderful journey of TOKEN

Team

- WHITEPAPER ; https://tokenlend.io/tokenlend_whitepaper.pdf

- WEBSITE ; https://tokenlend.io/

- TELEGRAM ; https://t.me/tokenlend

- TWITTER ; https://twitter.com/Tokenlend_news

- FACEBOOK ; https://www.facebook.com/tokenlend/

- MEDIUM ; https://medium.com/@tokenlend

- ANN THREAD ; https://bitcointalk.org/index.php?topic=2548329

Author

- Bitcointalk username : Melati21

- Bitcointalk Profile Link : https://bitcointalk.org/index.php?action=profile;u=1357963

- Facebook : https://www.facebook.com/reny.selwi

- Twitter : https://twitter.com/RenySelwi

- Telegram username : @Renyselwi

- Ethereum : 0x838d9F4750DFC63f9A75bdA335840C0A84aD3afc

Tidak ada komentar:

Posting Komentar